This article originally appeared in Forbes India magazine.

The second edition of the CNBC-TV18 Banking Transformation Summit presented by Nucleus Software, themed ‘Bharat’s Banking Roadmap for the Future’, brought together an array of business leaders, entrepreneurs, policymakers, and thought leaders, all united by a singular vision — building a developed and resilient Bharat by 2047. At the heart of this mission is the need to bridge the financial divide between urban India and rural Bharat through digital empowerment and accessible financial services.

India’s banking sector is critical to achieving the country’s ambition of becoming a $5 trillion economy. Nucleus Software, a pioneer in banking technology solutions for over three decades, has been a driving force in revolutionizing financial services worldwide. By leveraging cutting-edge technology, Nucleus Software is making financial services easier and more accessible for all.

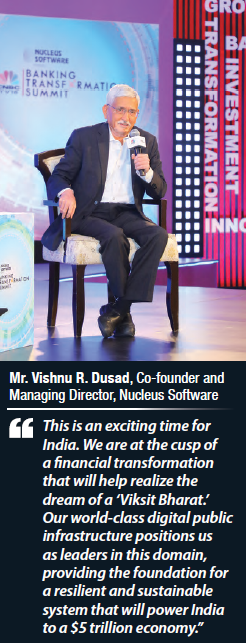

Speaking at the event, Mr. Vishnu R. Dusad, Co-founder and Managing Director of Nucleus Software, remarked: “This is an exciting time for India. We are at the cusp of a financial transformation that will help realize the dream of a ‘Viksit Bharat.’ Our world-class digital public infrastructure positions us as leaders in this domain, providing the foundation for a resilient and sustainable system that will power India to a $5 trillion economy.”

As India’s banking journey evolves, the future looks promising. Customers are increasingly demanding personalized experiences, and fintechs are stepping up to fill gaps in the market. However, challenges remain due to the diverse needs of the country’s population. Nucleus Software is at the forefront of addressing these challenges, combining emerging technologies with hyper-personalized solutions that enhance customer satisfaction. Nucleus Software is at the forefront of addressing these challenges, leveraging emerging technologies to deliver hyper-personalized solutions that enhance customer satisfaction. Currently, Nucleus Software facilitates over 26 million transactions each day through FinnAxia®, its globally integrated transaction banking suite. Their flagship digital lending platform, FinnOne Neo®, manages over $500 billion worth of loans in India alone and more than $700 billion globally (excluding India), while enabling over 500,000 users to log in daily.

As India’s banking journey evolves, the future looks promising. Customers are increasingly demanding personalized experiences, and fintechs are stepping up to fill gaps in the market. However, challenges remain due to the diverse needs of the country’s population. Nucleus Software is at the forefront of addressing these challenges, combining emerging technologies with hyper-personalized solutions that enhance customer satisfaction. Nucleus Software is at the forefront of addressing these challenges, leveraging emerging technologies to deliver hyper-personalized solutions that enhance customer satisfaction. Currently, Nucleus Software facilitates over 26 million transactions each day through FinnAxia®, its globally integrated transaction banking suite. Their flagship digital lending platform, FinnOne Neo®, manages over $500 billion worth of loans in India alone and more than $700 billion globally (excluding India), while enabling over 500,000 users to log in daily.

In today’s financial ecosystem, data is the backbone. At Nucleus Software, the Nucleites understand the significance of safeguarding customer data, ensuring both security and transparency. This commitment to client-centric solutions has earned the trust of over 200 financial institutions across more than 50 countries. Whether it’s retail banking, SME finance, Islamic finance, Automotive finance, transaction banking or financial inclusion, Nucleus Software’s journey has been marked by innovation, integrity, and a deep understanding of the evolving financial landscape.

Financial resilience goes beyond surviving economic disruptions; it’s about strengthening individuals and communities. Mr. Dusad emphasized the importance of treating the money handled by financial institutions as though it were their own. This mindset fosters accountability and drives the creation of innovative solutions that prioritize the security of society’s deposits. The result is a more secure and resilient financial ecosystem, built on trust and long-term stability.

Indian banks are among the strongest globally, and with the right technology and regulatory frameworks, they have the potential to achieve even greater heights. Mr. Dusad noted that the RBI plays a pivotal role in balancing innovation with accountability. By fostering a collaborative ecosystem, financial institutions can uplift underserved populations while maintaining a commitment to security and trust.

Looking to the future, Nucleus Software is committed to creating solutions that are robust, scalable, and capable of serving the diverse needs of India’s population. Collaboration between financial institutions, fintechs, and technology providers is rapidly increasing. Nucleus Software is at the forefront of this movement, working closely with stakeholders to not only help serve the unbanked population but also empower the financial services industry to provide comprehensive and accessible financial services while fostering trust, innovation, and sustainability.