Explore how CFSS empowers NBFCs in alignment with RBI guidelines. Unlock growth opportunities with our comprehensive financial services solution.

The financial services industry has been undergoing a transformational shift towards digitization, and the pandemic has accelerated this change. Non-Banking Financial Companies (NBFCs) faced multiple challenges in servicing their customers during the pandemic, hence the Reserve Bank of India (RBI) proposed guidelines to prepare for similar situations going forward. The Core Financial Services Solution (CFSS) is the RBI guiding framework that enables NBFCs to handle customers effortlessly and ensures a seamless digital customer interface, even during the unprecedented times.

CFSS is proposed for NBFCs on similar lines of Core Banking Solutions (CBS) widely used by banks. CFSS guidelines provide a centralized accounting record and database, allowing NBFCs to integrate different functions onto a single platform, thus providing a seamless digital customer interface. CFSS brings all the related functions of an NBFC onto a single platform, enabling ease of access for their operations team and customers.

CFSS provides a user-friendly and easily navigable digital customer interface that allows customers to access NBFC services effortlessly through multiple channels.

CFSS enables customers to access NBFC services from anywhere, at any time, using any device. NBFCs should ensure that CFSS services are available 24×7 and accessible through multiple channels.

CFSS integrates different functions of an NBFC on a single platform, providing a seamless digital customer interface. The integration must include loan origination, servicing, and collection, among others.

The centralized accounting record and database of the CFSS enable NBFCs to access real-time customer data and transaction history. The centralization of accounts reduces the need to open multiple systems and minimizes the customer’s need to contact the operations team for most of their queries or requests. Ensuring a Robust, Secure and Scalable CFSS is vital for managing a centralized database.

CFSS provides reporting and MIS capabilities that enable NBFCs to track their performance and make informed decisions. Real-time reporting and MIS should be available and accessible through multiple channels.

NBFCs are required to prepare a detailed plan for CFSS implementation along with major milestones, which is to be submitted to their board / committee for approval. Starting quarter ending March 31, 2023, all NBFCs need to submit a progress report to the Senior Supervisory Manager (SSM) Office of Reserve Bank.

Currently, there is an unavailability of an online customer portal or application where required services can be accessed 24X7. NBFCs need to develop bespoke solutions to address this need. Additionally, a centralized system of database containing all required details on a single platform for operations is unavailable. NBFCs face several challenges in implementing CFSS, as many times there are no proper linkages of information across different systems, causing a major hindrance. Different systems use their own method/scheme/process to store data, and hence, intermediatory linking needs to be developed and maintained for connecting these multiple systems. Also, the available CBS Solution (Implemented by scheduled Banks) is expensive and has many surplus features that are not required by most NBFCs.

To address these challenges, Nucleus Software, with more than three decades of experience in the BFSI industry, is offering lending solutions that provide digital channels for NBFCs with an easy-to-use, frictionless interface, and superior customer journeys. The lending suite delivers an end-to-end solution for loan lifecycle management, including origination, servicing, and collections. The new-generation systems built on the latest technology stack backed by 540+ APIs help in seamless execution of customer requests and transactions by the operations team. Nucleus Software is skilled at developing customised, bespoke digital solutions developed as per specific NBFC needs. Nucleus Software addresses NBFC requirements through their services team via digital transformation and data management & analytics offerings.

Nucleus Software’s team is adept at implementing various reporting tools such as Power BI, SAP-Business Objects, Tableau, and many more utilizing data available from periphery systems to generate customized reports. Some use cases of this consolidated data are Early Warning System, Customer Churn Prevention, Pre-authorized Lending Limits for Proactive Marketing Campaigns, to name a few.

NBFC systems are complex and subjected to many compliances; Nucleus Software’s in-depth understanding of compliances empowers NBFCs locally and globally to stay totally compliant.

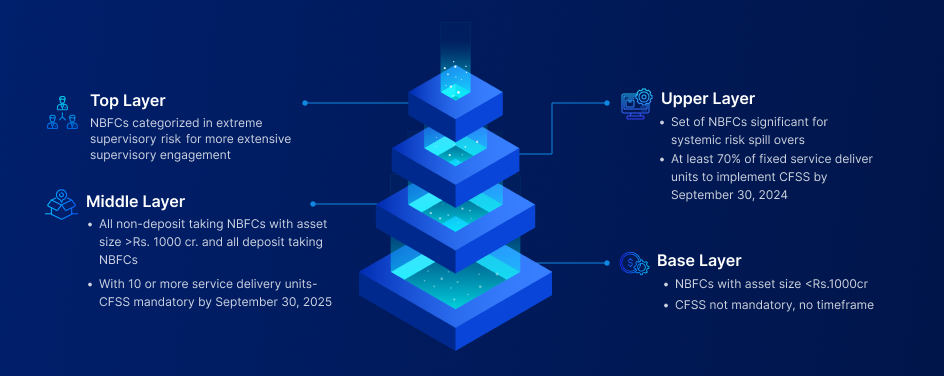

In October 2021, RBI introduced SBR- Scale Based Regulations, that divided NBFCs into four layers:

CFSS is a step towards digitization and will help NBFCs enhance customer experience and fuel growth. CFSS is expected to revolutionize the customer experience of end-users while strengthening the financial system pertaining to NBFCs.

Nucleus Software’s solutions and products are designed and evolved to fulfil the CFSS mandates and provide an efficient, secure and scalable app and infra-architecture that can sustain over a decade while providing a seamless user experience. With Nucleus Software’s expertise and solutions, NBFCs can transform their technological landscapes towards a better and compliant future.