Whether it’s a bank or a flourishing NBFC, it is important that we accept the fact, that the “Success” of an organization, not only depends on champion products or services it can provide, but also on the way it operates with respect to the three trinities Environment, Social and Governance.

While earlier generations of banks and NBFC’s mainly focused on profit maximization; recent developments in the sector highlight the fact that the new generation banking customers are not drawn towards companies or businesses that treat poorly, the environment it operates in or the people it deals with.

While earlier generations of banks and NBFC’s mainly focused on profit maximization; recent developments in the sector highlight the fact that the new generation banking customers are not drawn towards companies or businesses that treat poorly, the environment it operates in or the people it deals with.

While earlier generations of banks and NBFC’s mainly focused on profit maximization; recent developments in the sector highlight the fact that the new generation banking customers are not drawn towards companies or businesses that treat poorly, the environment it operates in or the people it deals with.Today, with the vast plethora of information available and absorbed online by consumers daily, the environment centricity and people centricity is far more crucial. Transparency and focus on ESG compliances for banks and NBFC’s is more than ever now. Leading FIs around globe are on a transformational journey to achieve net zero carbon footprint to increase acceptance amongst stakeholders as well as regulatory authorities and most importantly strive to play a responsible role towards creating a sustainable organisation.

Nucleus Software has over 35 years’ experience and expertise of providing financial products and services to banks and NBFC’s. We have been working towards being sustainable for decades now and the same ideology is adopted in the solutions we have designed for our customers to enable them to traverse the new realms. Our products and services enable and empower our customers to develop sustainable financial services that have significantly contribute towards ESG criteria’s in the below areas.

Nucleus Software has over 35 years’ experience and expertise of providing financial products and services to banks and NBFC’s. We have been working towards being sustainable for decades now and the same ideology is adopted in the solutions we have designed for our customers to enable them to traverse the new realms. Our products and services enable and empower our customers to develop sustainable financial services that have significantly contribute towards ESG criteria’s in the below areas.

Banks and NBFCs require a plethora of documentation to assess intent & capability of the borrower. Nucleus Software’s lending solutions ensure environmental sustainability by providing paperless transactions for citizens and corporates opting to apply for loans. Using Nucleus Software’s origination mobile application, customers can scan and upload different types of documents in an accurate and flawless electronic form. Unlike traditional solutions, the entire banking life cycle uses the same e-documents without any need for printing any document at any stage. All approvals are provided on the same e-documents within the system thus saving huge piles of paper consumption and storage. Our Apps also support document less approval of deviations of banks policies providing a completely sustainable technology solution.

Our globally acclaimed lending Platform has inherent capabilities to support green initiatives like zero dependency on physical document collection and dedicated e-document repository across the acquisition, servicing and collections process ensures that we deliver a truly paperless experience along the complete lending lifecycle.

Mobility Capabilities and use cases like document OCR, Auto receipt generation, Auto verification and validations help lenders and end users in not just streamlining and shortening the overall lending process but also in reducing the carbon footprint considerably by providing capabilities for FI’s field agents to reduce customer visits mitigating the need for physical visits as well as creating optimised routes to shorten time and distance travelled.

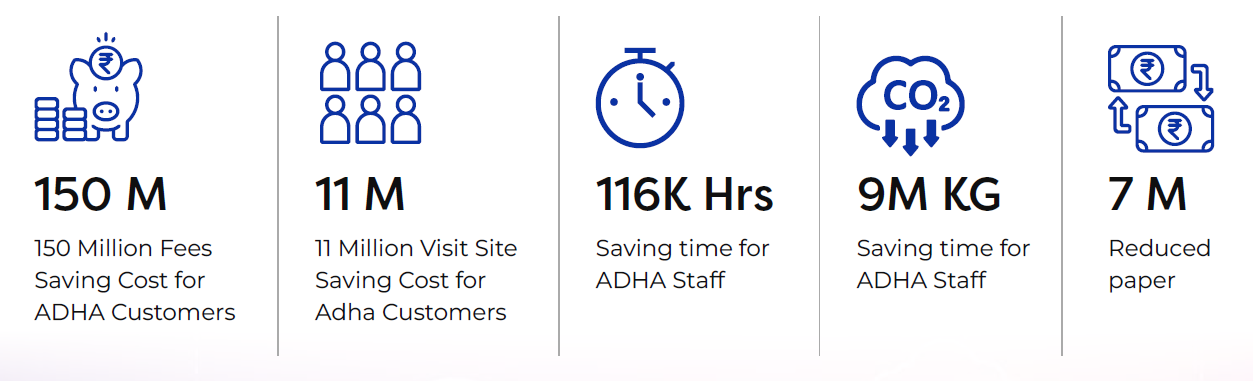

We have also developed self-onboarding solutions for loans and cards for end-users of banks and NBFC’s. Customers of these banks and NBFC’s (who in turn are Nucleus Software’s final customers) use our e-portals and mobile app to register, verify submitted electronic documents and apply for loans or cards. The benefit to environment is invaluable and unquantifiable as our state-of-the-art technology products not only save paper but also reduce miles and miles of multiple commutations to banks by customers and agents, which in turn saves not only fuel but also time and efforts of citizens at large. One major example of our implementation of paperless economy is for the Government authority of GCC countries. The impact of our deployed solution is represented as below.

During the collection phase of lending (if the loan goes into delinquency) Nucleus Software’s solution uses in built algorithm within the system to optimize the collectors route plan and avoids fuel wastage. All receipts generated during this process are e-receipts saving piles/tonnes of paper. These features ensure that we assist in reducing the carbon footprint of not only our customers but end-users of financial services as well.

During the collection phase of lending (if the loan goes into delinquency) Nucleus Software’s solution uses in built algorithm within the system to optimize the collectors route plan and avoids fuel wastage. All receipts generated during this process are e-receipts saving piles/tonnes of paper. These features ensure that we assist in reducing the carbon footprint of not only our customers but end-users of financial services as well.

For centuries Banks had been deciding the factors and parameters to loan to Individuals or corporates. But today, in the modern age of artificial intelligence and machine learning, digital technologies are being given the responsibility of credit allocation. Governments and societies pay huge attention to credit practices of banks, as loans or credit exposures are considered very powerful means of wealth accumulation. In fact, many economies have employed laws to ensure fair access to credit and monitoring of discriminations (Ex. Equal Opportunity act in US or GDPR in Europe). Nucleus Software’s credit allocation engine leverages algorithms that provide equal opportunity for all through a fair and transparent process of credit allocation.

While fair credit exposure to all is one step; in order ensure fair practices at all times our products can be configured to communicate the right reasoning for rejection of loans and limited credit exposure ensuring transparency in credit underwriting. Our collection system follows a similar algorithm for fair collection of dues from defaulters with empathy and without any bias.

While fair credit exposure to all is one step; in order ensure fair practices at all times our products can be configured to communicate the right reasoning for rejection of loans and limited credit exposure ensuring transparency in credit underwriting. Our collection system follows a similar algorithm for fair collection of dues from defaulters with empathy and without any bias.

From a Financial Inclusion perspective, Nucleus Software’s products can be configured to enable small ticket loans of amounts as small as Rs 100 making small ticket loans possible and profitable. The microfinance industry has played a crucial role in providing financial services for the underbanked or unbanked segment. End-to-end digital capabilities can not only help micro-lenders increase their geographical reach but also enable users to create groups such as self-help or joint liability groups while providing affordable finance options using Nucleus Software’s FinnOne Neo® mFin application.

The Governance of financial systems is critical for the central bank and other regulatory authorities of a country. The lending policies of FIs hold great importance in the overall growth trajectory of the country, thus, FIs lending activities are subjected to rigorous governance and reporting by the Government, central bank and regulatory authorities. With these governance reports FIs and authorities stay aligned with respect to NPA’s, credit exposure and financial inclusion of the country.

The Governance of financial systems is critical for the central bank and other regulatory authorities of a country. The lending policies of FIs hold great importance in the overall growth trajectory of the country, thus, FIs lending activities are subjected to rigorous governance and reporting by the Government, central bank and regulatory authorities. With these governance reports FIs and authorities stay aligned with respect to NPA’s, credit exposure and financial inclusion of the country.

For RBI/Central banks these reports act as a single source of truth, thus requiring mandatory submission from banks and NBFC’s. Nucleus Software’s products solutions enable FI’s to provide these very critical and mandatory reports timely and accurately. The capability of generating regulatory reports like NPA, NHB, Bureau and CERSAI reporting along with reports for fair practices and governance helps FIs and in turn central banks for better governance within the economy.

Many countries have laws insisting that certain parameters should not be used to determine the credit exposure for an individual (parameters like race, sex, nationality, age, political connect etc). While considering credit exposure of individuals all these compliances are adhered to avoid any form of unfair playing ground. At Nucleus Software our products and solutions are developed keeping equality and fair practice in purview to ensure lenders provide equal access to credit to borrowers irrespective of bias. Our Rule engines are deployed by FIs to flag un-appropriate parameters or data points while making fair credit decisions and keeping exposure and risk mitigation under check.

At present, 29 countries and territories maintain some degree of mandatory ESG disclosure regulation. European Union’s Corporate Sustainability Reporting Directive (CSRD), which expands the existing Non-Financial Reporting Directive. The CSRD significantly broadens the number of in-scope companies and requires them to disclose on topics including human rights, environmental impacts, climate change, and the double materiality concept.

The Securities and Exchange Commission’s (SEC’s) proposed climate-related disclosure rules, issued on March 21, 2022, would impose new ESG reporting requirements on U.S. based companies. Additionally, there has been a proliferation of global regulations focused on responsible sourcing and mandatory human rights due diligence, including conflict minerals, Germany’s Supply Chain Act, and the Uyghur Forced Labor Prevention Act, amongst others.

While ESG compliances are mandatory in many countries, cost reduction, competitive advantage and sustainability are the main goals for banks and NBFC’s opting for it. Global investors are giving a lot of weightages to sustainable businesses in their decision making. Moreover, the next generation is more sensitive when it comes to people’s conditions, Ethical workplace and environmental affects while choosing the right employer.

As ESG becomes a strategic imperative for firms in Asia Pacific, those that mispresent or overstate their actions could face penalties of US$10 million or more and suffer damages to their brand and revenue. (Forrester research)