Streamlining Transaction Banking for Corporates.

FinnAxia® Global Receivables

Simplify Collections. Strengthen Liquidity. Scale Confidently.

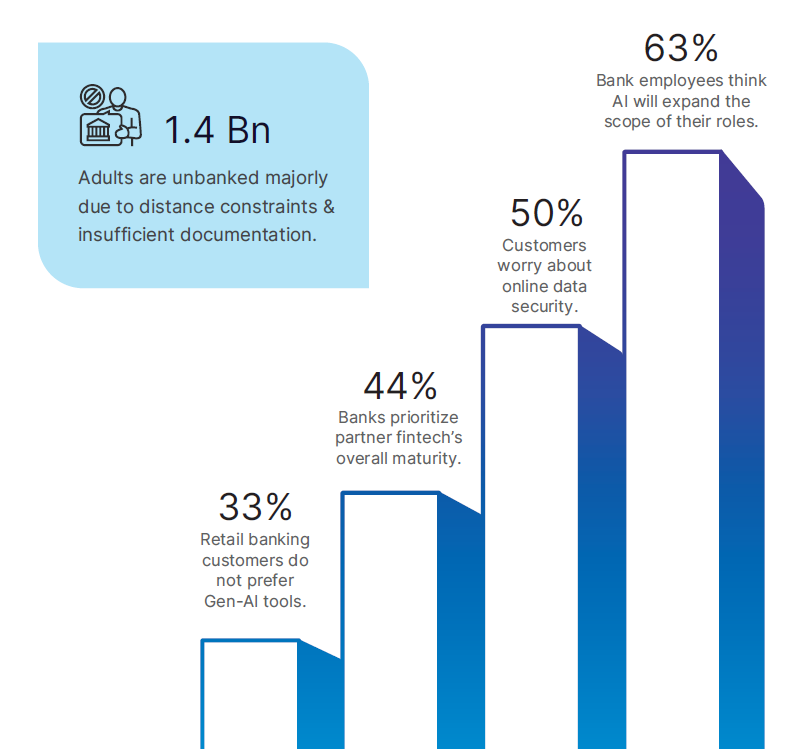

Learn moreThe 2024 Gartner Report* explores the key drivers reshaping the retail banking industry, emphasizing the importance of cybersecurity as consumers demand robust security measures amid rising data breaches. The report also highlights the growing significance of environmental, social, and governance (ESG) factors, particularly among younger consumers who prioritize sustainability in their banking choices.

Generational differences in banking preferences are noted, with younger customers seeking in-person support for complex transactions while valuing rewards and financial education. The emergence of generative Al introduces both optimism and caution, as customers recognize its potential but are hesitant about its use in significant financial decisions.

*All data and information based on Gartner Report: Shape Retail Banking Strategy With the Forces.

Overall, the report emphasizes the importance of embracing digital transformation, fostering a skilled workforce, and effectively managing technological debt as banks navigate these evolving dynamics.