Streamlining Transaction Banking for Corporates.

FinnAxia® Global Receivables

Simplify Collections. Strengthen Liquidity. Scale Confidently.

Learn more

Financial Institutions can achieve easy digital onboarding of rural borrowers as well as achieve cost optimisation through automated business processes.

Digital

on-boarding

Digital payments

Digital loan disbursement & collection

Digital charts of account

Digital credit scoring engine

MIS & analytics

Digital

on-boarding

Digital payments

Digital loan disbursement & collection

Digital charts of account

Digital credit scoring engine

MIS & analytics

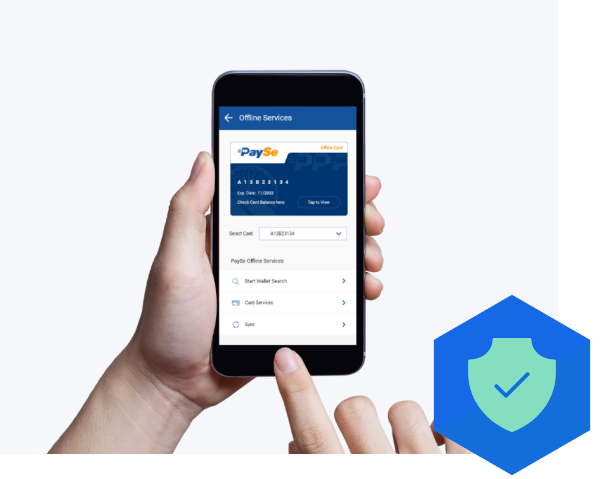

Capture customer data, verify documents, conduct KYC/AML checks and create customer accounts while in offline mode to onboard customers in remote areas with no internet connectivity

Digital wallet platform to make payments using smart phones instead of cash or cards when completely offline

India’s first Digitally Compliant Cash