Streamlining Transaction Banking for Corporates.

FinnAxia® Global Receivables

Simplify Collections. Strengthen Liquidity. Scale Confidently.

Learn moreStreamlining Transaction Banking for Corporates.

Simplify Collections. Strengthen Liquidity. Scale Confidently.

Learn moreAn advanced technology platform, designed to deliver agile and efficient solutions while drastically reducing the cost of operations.

End-to-end digital lending across the entire lifecycle of origination, servicing & collections.

Learn more

Advanced Automotive Lending Software for complete loan life cycle management.

Learn moreDigital Transaction Banking suite that is modular for a composable banking experience.

FinnAxia®, End-to-end Global Transaction Banking Suite; optimally manages Receivables, Payments, Liquidity, Financial Supply Chains and Corporate Trade.

Learn moreModern Technology Platform to Engage and Empower Customers.

India is rewriting the global financial playbook and Nucleus Software is at the heart of this transformation.

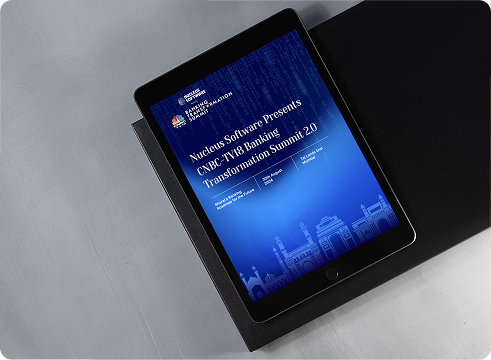

As the Knowledge Partner of Banking Transformation Summit (BTS) Season 3, we bring together the nation’s foremost banking leaders, regulators, and innovators to decode how AI-powered intelligence and credit-driven inclusion are shaping the future of finance.

This edition is more than an event – it’s a movement towards building Bharat’s financial tomorrow

For over four decades, Nucleus Software has been at the forefront of redefining banking technology – from pioneering digital lending platforms to enabling AI-driven, inclusive finance across the globe. At BTS 3.0, our leadership will set the tone for the day, highlighting our role in driving India’s next leap in banking transformation.

Parag Bhise

CEO and Executive Director,

Nucleus Software

In his Opening Note, Parag Bhise will emphasize our commitment to purpose-led innovation – ensuring banking not only evolves for Bharat but also helps shape its future.

Vishnu R. Dusad

MD & Co-founder,

Nucleus Software

In this fireside chat, Vishnu R. Dusad explores how India’s banks and NBFCs can leapfrog into the future with AI, automation, and next-gen credit systems to build a future-ready financial ecosystem.

Mr. Rajeshwar Rao

Deputy Governor, RBI

Deputy Governor, Reserve Bank of India (since Oct 2020; tenure till 2025). A career central banker with RBI since 1984, he holds a BA in Economics, an MBA (University of Cochin), and is a Certified Associate of the Indian Institute of Bankers.

He oversees regulation, risk, communication, enforcement, legal, and monetary policy, while also leading economic research and serving on the Monetary Policy Committee.

Hear directly from India’s most influential banking, fintech, and NBFC leaders.

Explore how AI and credit inclusion are powering Bharat’s leap to a $30 trillion economy.

Gain actionable insights on resilience, innovation, and customer trust.

Witness Nucleus Software at the forefront of building Bharat’s banking blueprint.

7:00 PM

Felicitation

Shereen Bhan, CNBC-TV18 & Vishnu Dusad, MD, Nucleus Software

7:10 PM

Fintech Panel

Fintech 3.0: Improving Scale & Sustainability

Vishnu R. Dusad

MD & Co-Founder,

Nucleus Software

Parag Bhise

CEO & Executive Director,

Nucleus Software

Sudipta Roy

MD & CEO, L&T Finance

Sohini Rajola

Executive Director –

Growth, NPCI

Raul Rebello

MD & CEO, Mahindra

Finance

Rajneesh Karnatak

MD & CEO, Bank of India

K. V. S. Manian

MD & CEO, Federal Bank

Ashok Chandra

MD & CEO, Punjab

National Bank

Upasana Taku

Co-Founder & CFO,

MobiKwik

Jairam Sridharan

MD, Piramal Finance

Anubrata Biswas

MD & CEO, Airtel

Payments Bank

This e-book distills key takeaways from the Banking Transformation Summit 2.0. It highlights how financial inclusion, technology, and strategic partnerships are shaping a resilient, future-ready banking ecosystem—poised to drive India’s growth journey.