Non-performing loans (NPLs) refer to problem loans that have ceased to generate interest or principal repayments, typically due to a borrower’s financial distress. NPLs are a critical concern for the banking sector, impacting financial stability and economic growth.

Understanding NPLs is crucial for banks as they directly affect their financial health and overall stability. In this article, we will delve into the causes and consequences of non-performing loans, exploring strategies for mitigating their impact on financial institutions and the broader economy.

When Does a Loan Become NPL?

Generally, loans are classified as non-performing when interest or principal payments are overdue for more than 90 days. These bad loans are further classified into the following categories:

- Sub-standard Asset: Sub-standard assets are overdue for less than or equal to 12 months. Even though it’s not performing, there’s still a fair chance of recovering some or all of the amount owed.

- Doubtful Assets: Doubtful assets, on the other hand, are those that have remained as NPAs for more than 12 months. This extended period of non-performance suggests a higher level of risk and the likelihood of getting back the full amount decreases.

- Loan Assets: The Loss Asset category includes distressed assets that have an extended period of non-payment. Recovering any part of the loan amount becomes extremely difficult in this stage, and the bank acknowledges the impossibility of fully recovering the asset. This classification system provides a nuanced understanding of the extent and duration of non-performance.

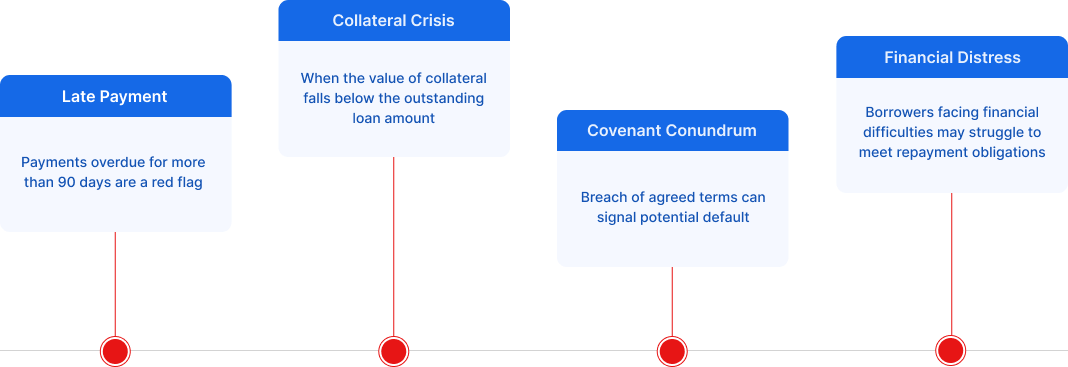

Key Indicators for Identifying NPLs

Several indicators help banks and financial institutions identify potential NPLs. Here are some red flags they should look out for:

Impact of NPA Classification on Banks or Lender Institutions

The presence of a significant number of non-performing loans can have severe implications for banks as follows:

- Interest Income Erosion: NPLs erode a bank’s interest income, leading to financial losses and reduced ability to lend.

- Profitability Plunge: The existence of NPLs lowers a bank’s profits and concurrently heightens its risk exposure, potentially leading to financial instability.

- Capital Drain: NPLs can deplete a bank’s capital, impacting its ability to maintain a healthy Capital Adequacy Ratio, absorb losses, and meet regulatory requirements.

- Credit Rating Downgrade: A high NPL ratio can adversely affect a bank’s credit rating, impacting its ability to raise funds at favorable rates.

Why Non-Performing Loans (NPLs) Spell Trouble?

Non-Performing Loans bring more than just financial challenges. They cast a shadow on the broader economic landscape. Let’s explore why NPLs are considered detrimental:

- Banking Stability at Risk: High levels of NPLs pose a systemic risk, creating ripples that can affect the overall stability of the banking sector. As these non-performing assets accumulate, they introduce an element of uncertainty, potentially impacting the confidence of both depositors and investors in the banking system.

- Slowing Economic Growth: NPLs act as a bottleneck, hindering banks’ capacity to extend credit. Since credit is the lifeblood of economic expansion, the reluctance to lend due to NPL concerns can impede businesses’ ability to invest and grow. This, in turn, slows down the pace of overall economic development.

- Constricted Credit Availability: Banks burdened by a high volume of NPLs become cautious about lending to new borrowers. This cautious approach, while understandable from a risk-management perspective, results in reduced credit availability. The consequence is a credit crunch, where individuals and businesses find it increasingly challenging to access funds for various needs, from home purchases to business expansions.

- High Cost for Borrowers: The higher the risk for banks, the higher the cost of borrowing becomes for individuals and businesses. As banks grapple with the potential losses associated with NPLs, they may adjust interest rates to compensate for increased risk. This, in turn, affects borrowers who face elevated costs when seeking loans, further dampening economic activity.

How to Successfully Navigate Non-Performing Loans?

In the dynamic world of banking, staying clear of Non-Performing Loans requires proactive tactics and strategic foresight. Here’s how to safeguard against NPL accumulation:

- Rigorous Loan Underwriting: Prioritize a meticulous underwriting process as the primary defense against potential NPLs. Thoroughly evaluating borrower creditworthiness ensures loans are extended to those likely to meet repayment obligations, minimizing the risk of default.

- Vigilant Borrower Monitoring: NPLs act as a bottleneck, hindering banks’ capacity to extend credit. Since credit is the lifeblood of economic expansion, the reluctance to lend due to NPL concerns can impede businesses’ ability to invest and grow. This, in turn, slows down the pace of overall economic development.

- Robust Collateral Management: Banks burdened by a high volume of NPLs become cautious about lending to new borrowers. This cautious approach, while understandable from a risk-management perspective, results in reduced credit availability. The consequence is a credit crunch, where individuals and businesses find it increasingly challenging to access funds for various needs, from home purchases to business expansions.

- Proactive Intervention for Early Warning Signs: The higher the risk for banks, the higher the cost of borrowing becomes for individuals and businesses. As banks grapple with the potential losses associated with NPLs, they may adjust interest rates to compensate for increased risk. This, in turn, affects borrowers who face elevated costs when seeking loans, further dampening economic activity.

- Strengthened Risk Management Practices: Establish a resilient risk management framework to navigate uncertainties effectively. Continual assessment and mitigation of risks bolster the bank’s financial stability and inspire stakeholder confidence.

What Does the Future Hold For NPLs?

The future of non-performing loans globally is marked by a combination of challenges and opportunities. As economies evolve, the risk of NPLs looms large, especially in the aftermath of economic downturns.

However, governments and financial institutions worldwide are increasingly focusing on proactive measures to mitigate the risk of bad debts. They are employing advanced analytics, artificial intelligence, and innovative debt resolution strategies to enhance their risk management practices.

Additionally, the emergence of fintech solutions and blockchain technology is reshaping the landscape by streamlining loan processes and enhancing transparency. Collaborative efforts between the public and private sectors will likely play a pivotal role in cultivating a resilient global financial system, thus promoting economic stability in the face of NPL challenges.

Debt Recovery Reinvented: FinnOne Neo® Collections Suite

When it comes to proactive strategies to manage NPLs, an efficient debt collections system becomes indispensable. A well-designed debt collections system serves as a strategic apparatus for financial institutions to systematically recover funds, maintain a healthy cash flow, and reinforce overall financial stability.

FinnOne Neo® Collections Suite seamlessly integrates with proactive strategies, positioning itself as a next-generation platform designed to empower financial institutions with a robust array of extensive debt collection strategies.

By facilitating end-to-end customer follow-up activities and communication, the suite stands out for its customer-centric approach and the provision of a comprehensive 360-degree customer exposure view to collections teams.

This advanced platform is not merely a software solution but rather a sophisticated tool that aligns with the strategic objectives of financial institutions to ensure a seamless and highly tailored approach to debt recovery.

How Collections Suite Can Help in Reducing NPLs?

Here are some impactful features of FinnOne Neo® Collection Suite that effectively contribute to reducing NPLs:

- Streamlined Collections Process through Automation: Composable banking allows pliancy with the freedom to operate with smarter technology and models, it also keeps the bank up to date with the market trends on a regular basis and not necessarily wait for big developments executed in the gap of years.

- Data-Driven Insights for Informed Decision-Making: With cloud-based technology, AI and ML banks are fast and furious with the kind of journeys that can be developed for their customers. The ‘how to’ and ‘what to’ do when the customer behaviour changes beyond the set use cases – is much easier with a composable approach.

- Seamless Integration with Existing Systems: The Collections Suite seamlessly integrates with a bank’s infrastructure, ensuring smooth operations without disrupting existing workflows.

- Elevating Customer Experience and Satisfaction: Beyond merely focusing on debt recovery, the suite prioritizes enhancing customer experience and satisfaction. Through improved communication and transparency, it fosters stronger relationships with customers, ultimately leading to elevated levels of satisfaction and loyalty.

Financial institutions using FinnOne Neo® Collections Suite have achieved remarkable results, such as a 15% Y-o-Y Increase in Collection Rate and a 22% Increase in Cases for follow up generated through the collections suite per last year.

Wrapping Up

Effectively managing non-performing loans is vital for financial sector stability and economic well-being. Proactive strategies, such as rigorous loan underwriting and ongoing monitoring, are key to preventing bad debts and NPL accumulation.

Advanced technologies like FinnOne Neo® Collections Suite are invaluable tools in this endeavor. Seamlessly integrating with proactive strategies, they offer extensive collection solutions for financial institutions.

In summary, addressing NPL challenges requires a multifaceted approach. By combining proactive strategies with technological innovations, institutions can safeguard their stability and contribute to sustained economic growth.

Lending

Lending

Transaction Banking

Transaction Banking Financial Inclusion

Financial Inclusion