Opening the Door to Financial Access

Across Africa, millions of entrepreneurs, smallholder farmers, and SMEs operate beyond the reach of traditional banking systems. Many fall into the “credit invisible” category – those without a formal credit history but who show strong repayment potential through alternative data sources such as mobile money transactions, utility bill payments, and mobile usage analytics.

This is where co-lending in Africa is transforming financial inclusion. African fintech companies have built agile digital lending platforms capable of analyzing non-traditional credit signals to generate accurate credit profiles in days instead of weeks. African banks, meanwhile, bring scale, regulatory compliance frameworks, and the liquidity required to fund these loans responsibly.

Related Read: Co-Lending: Revolutionizing Financial Inclusion through Collaborative Lending Strategies

Figure 1: Co-lending: Bank Fintech Partnership

In this bank–fintech partnership model, banks provide capital while fintechs manage loan origination, AI-driven credit scoring, and borrower engagement, refer to Figure 1. By sharing both the lending risk and the customer data, co-lending makes it possible to extend credit to underserved markets without overexposing any one institution. To scale this across the continent, robust digital infrastructure is essential – interoperable platforms, secure data-sharing protocols, and API-driven integrations that allow seamless bank–fintech collaboration.

What Makes Co-Lending Work Today?

In today’s fast-moving lending market, co-lending isn’t just about partnerships on paper – it’s about having the right technology backbone to make those partnerships work in real life. Without a solid platform in place, processes get messy, compliance slips, and decisions slow down.

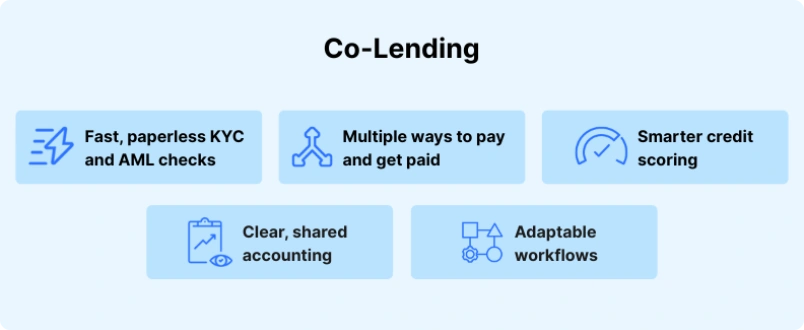

Figure 2: Co-lending Capabilities

The best digital co-lending setups bring a few key capabilities together, refer to Figure 2:

- Fast, Paperless KYC and AML Checks – Direct links to national ID systems and global watchlists mean lenders can verify borrowers in minutes instead of days.

- Multiple Ways to Pay and Get Paid – Whether it’s a mobile wallet, a bank transfer, or through an agent in the borrower’s neighbourhood, platforms make repayments and disbursements simple and flexible.

- Smarter Credit Scoring – AI tools now combine traditional credit data with alternative signals, giving lenders a clearer picture of a borrower’s risk — especially useful for first-time borrowers.

- Clear, Shared Accounting – Dual-ledger systems automatically track capital, interest, and revenue sharing, so both the bank and the fintech partner are always looking at the same numbers.

- Adaptable Workflows – From changing regulations to launching a new loan product, platforms can adjust quickly without major redevelopment.

When these features come together, co-lending moves from being a promising idea to a practical, scalable way to grow financial inclusion – especially across fast-growing markets like Africa, where speed, trust, and flexibility can make all the difference.

The African Advantage: Conditions for Growth

Africa’s co-lending potential is strengthened by:

- Regulatory sandboxes in Kenya, Nigeria, and South Africa for safe innovation testing.

- Open banking and API standards that enable data interoperability between banks, fintechs, telcos, and credit bureaus.

- Risk-sharing frameworks like CREDICORP and NIRSAL that foster trust.

- Rich alternative credit data sources – from prepaid electricity purchases to mobile airtime top-ups – that help serve new-to-credit borrowers.

Closing the Credit Gap in Nigeria with Co-Lending

In Nigeria, co-lending adoption is accelerating thanks to initiatives like CREDICORP (2023), designed to expand credit access to underbanked communities. Through co-lending partnerships, banks tap fintech distribution networks that reach deep into rural and informal markets, while fintechs leverage bank liquidity to grow without carrying all the credit risk.

This BFSI co-lending strategy benefits both sides – fintechs focus on customer acquisition, mobile-first loan applications, and the user experience, while banks ensure compliance, risk management, and oversight. The outcome? Loan approval and disbursement times drop from weeks to hours, matching the expectations of Africa’s digitally savvy borrowers.

Kenya’s Mobile-First Lending Revolution

Kenya is a global leader in mobile money adoption, with over 38 million active mobile money accounts – more than the country’s adult population. Platforms like M-Pesa have embedded digital payments into daily life, enabling the rise of mobile-based lending solutions.

Fintech lenders such as Tala, Branch, and M-Shwari analyze transaction data, repayment histories, and smartphone usage to assess borrower creditworthiness in real time. Partnerships with established banks like Kenya Commercial Bank (KCB) combine fintech agility with the trust, governance, and AML/KYC compliance of traditional financial institutions.

This mobile-led co-lending model has opened up micro-loans tailored for Africa’s informal economy – supporting gig workers, smallholder farmers, and informal traders with credit solutions that align to their income cycles.

The Road Ahead for Co-Lending in Africa

Though still in its early growth phase, Africa’s co-lending market is fast becoming a mainstream digital lending strategy. The next wave will be powered by:

- Banks prioritizing technology-first partnerships.

- Fintechs reinforcing governance and regulatory compliance.

- Regulators balancing consumer protection with innovation.

The winners will be those who leverage scalable, interoperable platforms – connecting banks, fintechs, and alternative lenders into unified ecosystems. These platforms will harness real-time data, AI-driven credit insights, and automated workflows to deliver the right credit, to the right people, at the right time – helping Africa achieve its financial inclusion goals at scale.

Lending

Lending

Transaction Banking

Transaction Banking Financial Inclusion

Financial Inclusion