This article originally appeared in Business Today magazine.

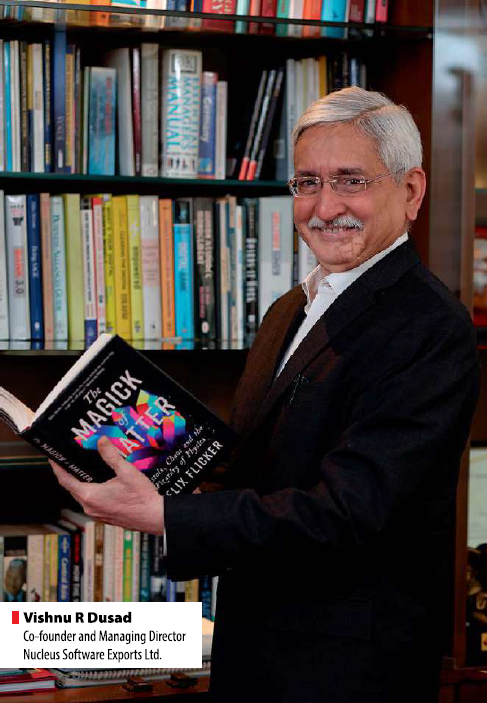

Imagine a company that started its journey in a small garage office in Delhi with a bold vision of making financial services access easy and enriching worldwide in the late 1980s and, over the next thirty plus years, grew to become a global leader in banking and financial services technology. That’s the story of Nucleus Software – a tale of relentless innovation, unwavering commitment, and transformative growth. From launching India’s first online ATM to managing over $1200 billion in loans worldwide today, Nucleus Software has been a beacon of excellence dedicated to the BFSI sector. At the heart of Nucleus Software is a mission to revolutionize the banking and financial services sector. Guided by visionary leadership of Mr. Vishnu R Dusad, the company has growth into a trusted partner for over 200+ countries. Whether it’s Retail Lending, Corporate & SME Finance, Islamic Finance, Automotive Finance, Transaction Banking, Mobile & Internet Banking, or Financial Inclusion, Nucleus Software has developed future-proof robust technology platforms that have end-to-end transformed financial services on a global scale.

Central to Nucleus Software’s achievements is FinnOne Neo®, a versatile digital lending platform that has been described as the Swiss Army knife of its kind. FinnOne Neo® simplifies the entire lending process – from origination to collections – offering a seamless experience for both institutions and their customers. With advanced features like sophisticated content and collateral management and omni-channel support, including web, mobile, and WhatsApp, FinnOne Neo® sets a new benchmark in loan management. Boasting a comprehensive 480+ API stack, FinnOne Neo® ensures robust, secure, quick, and agile integration, facilitating seamless interoperability with a wide range of systems, making integrability and compatibility with other providers paramount.

Central to Nucleus Software’s achievements is FinnOne Neo®, a versatile digital lending platform that has been described as the Swiss Army knife of its kind. FinnOne Neo® simplifies the entire lending process – from origination to collections – offering a seamless experience for both institutions and their customers. With advanced features like sophisticated content and collateral management and omni-channel support, including web, mobile, and WhatsApp, FinnOne Neo® sets a new benchmark in loan management. Boasting a comprehensive 480+ API stack, FinnOne Neo® ensures robust, secure, quick, and agile integration, facilitating seamless interoperability with a wide range of systems, making integrability and compatibility with other providers paramount.

Equally significant is FinnAxia®, a globally integrated comprehensive transaction banking platform that streamlines a wide range of functions, including receivables, payments, liquidity management, supply chain, and corporate trade. Its modular design allows financial institutions to deploy components independently or integrate them into a unified system, thereby enhancing operational efficiency. By digitizing processes, FinnAxia® ensures operational excellence, total transparency, faster time to market, and straight-through processing, It features a corporate customer front end with a 360° account position view across multiple currencies and jurisdictions, empowering corporate to make informed decisions on their cash position. Each module can be used independently or as part of a single integrated platform, providing unmatched flexibility and scalability for financial institutions.

FinnOne Neo® and FinnAxia® are backed an inbuilt AI powered platform to realize the digital transformation goals of financial institutions worldwide. Additionally, both offer advanced forecasting capabilities and enriched intelligent reporting.

In the realm of financial inclusion, PaySe™ stands out as a groundbreaking solution. Designed to democratize finance, especially in remote areas, PaySe™ offers both offline and online digital cash capabilities. With three patents and a focus on facilitating small transactions in rural locations, PaySe™ not only supports digital onboarding of borrowers but also reduces cost of cash through automation.

The impact of Nucleus Software’s solutions is felt far and wide. Take, for instance, a leading bank that adopted the FinnOne™ Loan Management System in 1998. Impressed by the technology, the bank expanded its use to include customer acquisition and collections systems. This seamless integration allowed the bank to manage over 8.5 million loans worth $37 billion, all while maintaining a low Gross NPA of 0.93% in FY2015-16. Their success with FinnOne™ earned them the prestigious Celent Model Bank award.

Another notable success story is Poonawalla Fincorp Limited, a NBFC specializing in consumer and MSME financing. To achieve its ambitious growth targets, Poonawalla Fincorp as a customer-centric organisation, delivering a seamless user experience and robust, scalable solutions that redefined the loan application process.

Nucleus Software has not only established a leading position in India but has a strong presence globally earning the trust of leading FIs worldwide. Their innovative product services are utilized by prominent banks around the world, including DBS Bank, Bank of Sydney, PVcomBank, Bank of Queensland, and CRDB Bank, among others. This widespread adoption of their solutions underscores Nucleus Software’s reputation for delivering robust, reliable, cutting-edge solutions that meet the diverse needs of the global banking and financial services sector.

Nucleus Software is not just keeping up with industry trends; it’s setting them. By leveraging AI-powered solutions and robust cybersecurity protocols, the company is boosting investor confidence and driving economic growth. The integration of artificial intelligence and machine learning enhances decision-making and automates processes, setting new industry benchmarks. Nucleus Software is also exploring blockchain technology to boost security and streamline transactions, while leading the charge in open banking and API integration. With over 540 APIs, the company seamlessly connects to the ever-evolving financial ecosystem, promising immense potential for the future. By embracing innovations like Continuous Integrations/Continuous Delivery (CI/CD) and Acceptance Test-Driven Development (ATDD), Nucleus Software remains at the forefront of reshaping financial services. As fintech integrations increase both horizontally and vertically, Nucleus Software has equipped Financial Institutions to integrate seamlessly and securely.

As digital transactions surge, Nucleus Software prioritizes cybersecurity and data privacy, incorporating advanced measures to safeguard sensitive information and ensure trust. Facilitating over 26 million transactions daily through its globally integrated transaction banking platform, Nucleus Software’s lending platform manages $500 billion of loans in India and over $700 million of loans globally other than India, supporting more than 500,000 daily users. This expansive reach and robust infrastructure underscores Nucleus Software’s pivotal role in the global financial landscape.

Reflecting on the company’s journey, Vishnu R Dusad, Co-Founder & Managing Director, Nucleus Software, states, “Our journey began with a simple yet powerful vision. From our humble beginnings, we have been driven by an unwavering commitment to innovation and customer-centricity. By continuously evolving and addressing every consumer need in financial services, we strive to shape the future of digital banking and create lasting value for our clients. Over the years, our relentless pursuit of excellence has led us to develop technology that has also garnered global recognition. Today, Nucleus Software proudly serves over 200 banks and financial institutions across more than 50 countries. Our journey stands as a testament to the transformative power of innovation and the impact of thoughtful leadership.”

Nucleus Software’s journey has been a testament to the power of innovative thinking and unwavering determination. As an employee-centric company with a large workforce, Nucleus Software trusts its employees, giving them the freedom to innovate and express themselves. At Nucleus Software, employees believe in the overall development of both the company and themselves, continually reaching new heights. Many employees join Nucleus Software as freshers, climb the ladder to leadership roles, and stay with the company for years.

Looking to the future, Nucleus Software is dedicated to continue empowering financial institutions by proactively providing what the industry needs. By understanding customer nuances and ensuring end-to-end support and services, Nucleus Software delivers value, drives growth, and scales with its partners. This commitment to understanding market needs and delivering excellence positions Nucleus Software as a leader in the industry, setting new standards each year.